DecisionPoint® First-Party Auto Bill Review

When It Comes to Bill Review Configuration, One Size Doesn’t Fit All

Payer claims-handling philosophies vary across three core dimensions: policy language, risk tolerance, and regulatory interpretation. Yet most bill review platforms take a one-size-fits-all approach and apply the same rules to all clients. Your bill review platform should be designed around your philosophy and adapted to your business needs. With DecisionPoint®, you can customize your bill review program to your specific business strategy and claims-handling philosophy.

Book Your DemoThree Core Dimensions of Claims Handling Philosophy

Policy Language

Match adjudication to your policy language and internal processes.

Risk Tolerance

Set aggressiveness of adjudication strategies, processes and edits to prevent leakage while minimizing litigation exposure.

Regulatory Interpretation

Configure by jurisdiction. There’s no one-size-fits-all across states.

Seven Configuration Levers to Tailor Your Bill Review Program

DecisionPoint® gives you seven levers that put you in control of how bills are reviewed, so the process reflects your policies, priorities and ideal outcomes. Each lever is a choice point where you decide how aggressive or flexible your program should be to balance savings, speed and compliance. Start with the high-impact items, measure results and then tune iteratively.

Lever | What You Can Configure | Why It Matters |

|---|---|---|

Rules & Automation | Business configurable rules for straight-through processing and routing | Boost automation where human touch is not a value-add; free adjusters for complex work |

Coverage & Products | Apply fee schedules and benchmarks by coverage (e.g., PIP, MedPay) and sub lines | Align savings tactics to coverage economics |

Dates & Triggers | Effective date logic (e.g., use Date of Loss or Policy Effective Date to start a schedule) | Align with policy language and compliance |

Jurisdiction Profiles | State profiles (limits, fee schedules, benchmarks, unique state rules, out-of-state handling) | Remain in alignment with regulation and court rulings |

Clinical Edits | Level of clinical edit aggressiveness by risk tolerance, policy language and regulatory environment | Reduce leakage using defensible, low litigation edits |

Right Reviewer at the Right Time | Calibrate nurse, code review, WC/Auto PPO vs. first level bill review | Manage expense savings vs. loss cost savings |

AI Assist | Predict which bills won’t benefit from human touch to automatically straight-through process | Add precision to automation and reduce rework |

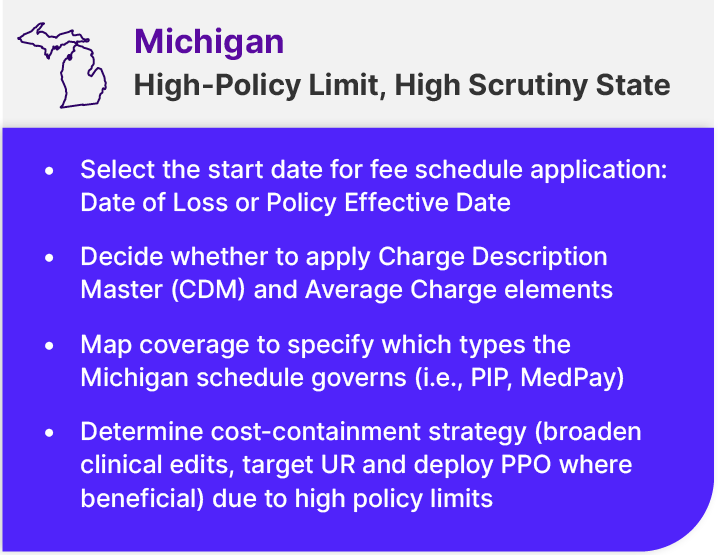

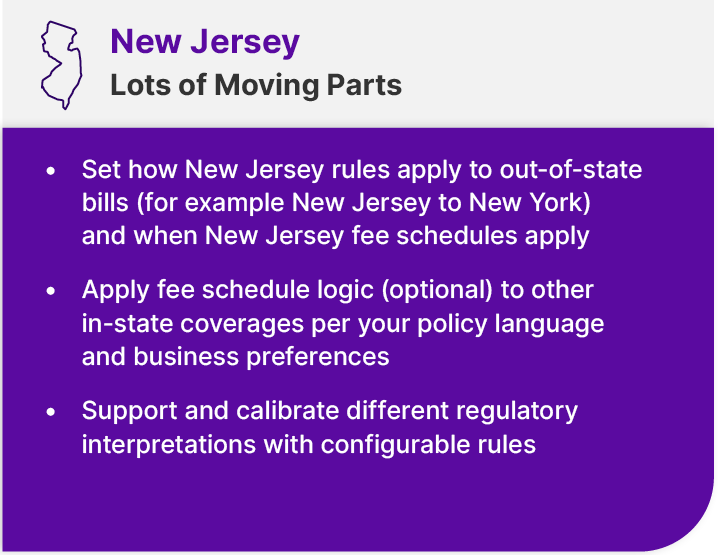

How Two States Prove the Case for Configurability

The following examples show how DecisionPoint® can be configured to address the unique complexities of two states (Michigan and New Jersey), demonstrating the power of a flexible, configurable bill review program.

Measure, Monitor and Tune Your Configuration

When your bill review configurations mirror your policy language, risk tolerance and regulatory interpretation, you stop trading accuracy for speed. DecisionPoint® reporting measures and monitors turnaround time, e-bill use, automation rate and reconsiderations. It compares results to industry benchmarks, not just your internal trends. When a metric dips, you can easily adjust the levers and recheck your results.

Convert your philosophy into predictable savings and compliance by starting with the highest-impact levers, measure what moves, then tune. DecisionPoint® turns your levers into executable configuration, so you iterate faster, depend less on IT and keep tight control over outcomes.

See DecisionPoint® in Action

Schedule a demo to map your policies to configurable levers.