As we enter 2022 still mired in the COVID-19 pandemic, the workers’ compensation industry faces another challenging year, with payers continuing to cope with staffing shortages, evolving regulatory changes and more. To help you navigate what’s next and understand this year’s top trends, we’ve outlined Enlyte’s top 2022 workers’ compensation predictions:

- Staffing Shortages Will Affect Employers and Payers

- The Mental Health Conversation Will Continue

- Automation, Claims Staff Efficiency Will Be at the Forefront

- The Pandemic Will Continue to Strain Hospitals, Providers

- Federal Regulatory and Legislative Changes Will Trickle Down to Workers’ Compensation

- The Regulatory Landscape Will Continue to Shift

- Drug Price Transparency Will Be a Focus; Opioid and Addiction Concerns Will Continue

Staffing Shortages Will Affect Employers and Payers

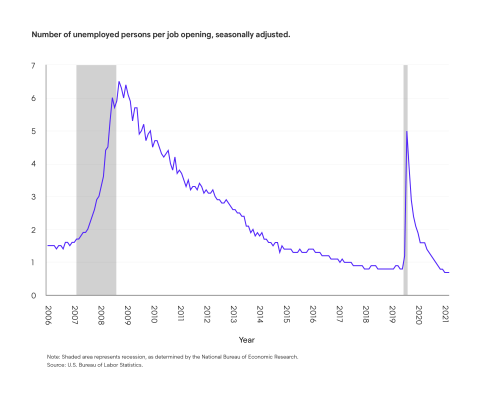

Across the U.S., there is at least one open job for every American seeking work, which is great news for anyone in the market for a new position, but not necessarily ideal for employers seeking qualified candidates and unable to meet productivity demands. The jobs with the highest vacancies are typically hourly employees and frontline workers. According to the Bureau of Labor Statistics, we can expect the labor force participation rate to decline from the current 61.7% to 60.4% in 2030, mainly due to the aging workforce.

As this trend continues throughout 2022, employers will look to retain employees and attempt to balance the work, life, health and productivity equation. Due to the shortages, many frontline employees are being asked to work overtime. Excessive overtime can lead to employee burnout, more turnover, poor health and increased incidence of injury. Employers need strong health and safety strategies in place, including ergonomic programs, to prevent injuries due to overexertion. Similarly, return-to-work programs will help get injured employees back to work and reduce the need for temporary labor or overtime.

“When injuries do occur, having a return-to-work program that allows for transitional duty during the recovery can help to accelerate the employee’s return to full duty, and while the injured employee may not be able to perform all the essential functions of their regular job, they can contribute to the employer’s overall output and may prevent the need for a temporary replacement.”—Tammy Bradly, VP Clinical Product Marketing

Staffing shortages throughout the country will affect a wide range of employers; insurance carriers and other claim organizations are facing this challenge as well. To reduce the risk associated with high turnover rates and onboarding new employees who have less industry experience than their predecessors, we anticipate the insurance industry will turn to technology, especially automation, to help fill some of the gaps.

The Mental Health Conversation Will Continue

Mental health in the workplace will continue to be a chief concern in 2022. As the pandemic lingers, so do associated stressors. Many employers are now recognizing mental health is not only as important as physical health, but also has a direct impact on physical health and overall wellbeing. According to a study conducted by the Centers for Disease Control and Prevention (CDC), the cost of treatment for those living with both a mental and physical condition can be twice or three times as expensive as treating a physical ailment alone. The researchers also acknowledged that people with physical health diagnoses are also more likely to have mental health concerns. Treating them together increases the likelihood of achieving improved outcomes and reduced costs.

Compounding the problem is a shortage of behavioral health professionals. For this reason, virtual behavioral health skyrocketed in 2021 and will continue to be a viable and highly utilized source for treatment.

Failing to address mental health indicators accompanying physical injuries can prolong recovery and increase the likelihood of those injured to develop chronic pain. This means employees who don’t receive appropriate l treatment could face years of debilitating pain which, in turn, can further erode mental wellbeing.

Studies have shown the likelihood of injured employees being treated for depression are 45% greater than non-injured counterparts. And getting hurt on the job can increase the risk of mental hardship.

“Having access to behavioral health specialists in workers’ compensation is no longer a ‘nice to have,’ it’s a ‘must have.’” —Anne Levins, Senior Vice President, Network Product & Analytics

Automation, Claims Staff Efficiency Will Be at the Forefront

As workers’ compensation payers continue to navigate challenges they are facing due to COVID-19, we anticipate many companies will focus on boosting claim staff efficiency through automation, outsourcing, technology and other tools in 2022.

At the height of the pandemic, technology use increased significantly in every industry, including workers’ compensation. While we may not see the technological boom in 2022 that we experienced in 2020, we do expect payers will continue steadily incorporating new technologies into their claims programs for many reasons such as filling gaps for staffing shortages, managing remote workforces and improving injured employee experiences.

Here are some technology initiatives our experts believe many payers will undertake in 2022:

- Boosting Automation: As workers’ compensation claims teams face staffing challenges, many will turn their focus to automating repeatable administrative tasks, allowing existing staff to work on the most complex and high-value projects. There are many technologies on the table, from improving straight-through processing using rules-engine automation to applying advanced predictive analytics.

- Improving Training: With more employee turnover comes the need for more training. In 2022, we expect the workers’ compensation industry to further embrace technology designed to help new employees get up to speed faster and incorporate automated guidance into their everyday tasks, reducing the need for printed manuals.

- Retaining Internal Expertise: To help mitigate the risk that comes with top employees leaving or retiring, claims organizations in 2022 will likely put a special focus on using technology to document and operationalize internal expertise so it doesn’t walk out the door with their employees when they leave.

- Improving User Experience and Workflows: In addition to boosting automation and improving training, claims organizations will look to offer better digital experiences and workflows for their staff, whether that means offering access to portals that streamline information in one place, or leveraging predictive analytics to ensure each person is assigned the right claim from the start to prevent delays and frustrations down the line.

While automation will most likely be at the forefront of the technology conversation next year, use of other technological formats will also continue to increase. For example, while telemedicine hasn’t maintained its initial usage boost from the initial months of the COVID-19 pandemic, its use remains above pre-pandemic levels, and there is still significant potential for innovation to help boost adoption rates in the future. Additionally, our experts believe advanced technology will begin to play a bigger role in the treatment of injured employees, such as health apps, digital therapeutic devices, virtual reality for pain management and more.

The Pandemic Will Continue to Strain Hospitals, Providers

The workers’ compensation system will continue to face access-to-care issues due to continued stresses from the pandemic. Hospitals, for example, were already grappling with enormous challenges before Omicron emerged as a highly transmissible variant. Now, an increase in breakthrough infections among vaccinated and even boosted health care workers continues to sideline essential staff, increasing caseloads for those who remain. These shortages, combined with burnout among clinicians worn down by nearly two years of operating in full-time triage mode, limit the ability of some hospitals to offer the best care possible. Already, some non-urgent surgeries and other essential services are being postponed to accommodate COVID-19 patients.

The stresses being felt throughout the health care system are likely to push some clinicians into retirement or into other fields thereby heightening already acute shortages among indispensable staff such as nurses. Provider scarcity will continue to be a concern even beyond the pandemic because a large proportion of doctors are nearing retirement while the nation’s population simultaneously ages. An older population, by its nature, is likely to place more demands on the health care system. And an older workforce and a rise in behavioral health challenges among workers will likely increase demand for specialty services in workers’ compensation. As injuries grow more complex, they might require more access to specialty care and more involved care coordination.

There are likely to be bright spots as well in 2022 as the innovations such as telemedicine and health-monitoring technology, pressed into service amid pandemic safety protocols, continue to evolve and serve as viable modes of delivering care. Amid all these changes, payers will look for clinical triage and case management programs to ensure those who are injured have access to high-quality and timely care delivered by the best provider networks.

Federal Regulatory and Legislative Changes Will Trickle Down to Workers’ Compensation

This year, the federal government will undertake major discussions on health-related topics including telemedicine and marijuana, that could have significant effects for the workers’ compensation industry. Here are a few of the major national issues we’ve got our eye on this year:

- Medical Marijuana: Our experts do not expect the FDA to approve medical marijuana federally in 2022. We believe the timeline for approval will be pushed out to 2023. We also expect there will be some movement related to recreational cannabis, whether that means de-scheduling, re-scheduling or decriminalizing. Any changes at the national level would be a major shift for the workers’ compensation industry, and will speed up the national conversation about reimbursement, banking, impairment, insurability and more.

- Ambulatory Surgical Centers: In an abrupt change of course, starting January 1, the Centers for Medicare and Medicaid (CMS) reversed the plan contained in its 2021 OPPS Final Rule to initiate a three-year phaseout of the 1,700 procedures on the Inpatient-Only List, starting with about 300 orthopedic procedures in 2021. Because the Phase 1 (2021) codes were orthopedic in nature, it was reasonable to assume we would see some shifting in utilization patterns from inpatient to outpatient/ambulatory surgery center use for at least some of those listed procedures in states where Medicare payment policies are followed for workers’ compensation. For 2022, the vast majority of these codes have been placed back on the Inpatient-Only List, leaving only the lumbar spine fusion, shoulder joint reconstruction, ankle reconstruction and the corresponding anesthesia codes to remain deferred to clinical judgment as to where the procedure will be performed. Enlyte experts will be analyzing data throughout this year to understand how the 2021 changes affected costs and utilization patterns last year and will attempt to understand how the 2022 reversal and selected CPT-level carve-outs might impact costs and utilization patterns this year.

- Telemedicine: The new CMS physician fee schedule that went into effect January 1 includes a few important telemedicine provisions. First, it removed geographic boundaries for mental health providers, allowing them to service patients virtually in more locations. This means if a provider is licensed to perform this service, he or she may do so across state boundaries. For other provider types, the new fee schedule expands compensability until 2023. While a few states, most notably New York, have reverted to their pre-pandemic telemedicine restrictions for workers’ compensation, we believe most regulatory bodies will follow in CMS’ footsteps to continue expanding access to telemedicine. Before permanent regulations can be put into place, the industry needs to better understand the role telemedicine is playing in workers’ compensation claims, including how it is affecting treatment patterns, costs and more.

“All eyes will be on the federal government in 2022, as they continue their discussions on major topics that could have significant effects for the workers’ compensation industry. Between serious conversations about what to do about marijuana laws, researching telemedicine’s role in the course of care and more, I do believe we will see significant movement on some of these issues this year.” —Lisa Anne Bickford, Director, Government Relations

The Regulatory Landscape Will Continue to Shift

In addition to the major initiatives happening at the federal level, there are a few other top-of-mind issue for 2022. While COVID-19-related regulatory changes, such as presumptions and vaccine mandates, will continue to take precedence, many state legislatures are playing catchup on the initiatives they had on the docket ahead of the pandemic. Below, we’ve listed a few key areas we’ll be keeping an eye on:

- COVID-19 Presumptions: During the pandemic, presumption laws have been expanded significantly to cover more types of employees exposed to the virus through their jobs and, in 2022, many states will continue widening those definitions. As the federal government institutes COVID-19 vaccine mandates for employees, some states are also considering broadening their presumption laws further to cover any adverse reactions from the vaccine. If these rules are put into place, it could set significant precedence for the workers’ compensation industry. In addition, we will be monitoring any changes to quarantine timelines that could result in shorter time-off-work durations.

- Work From Home: As more employees work remotely, we’re starting to see workers’ compensation claims from home offices. As these cases continue to arise and go to court, new case law will be developed to help determine how the industry should cover such injuries, such as when a remote employee trips over her dog in the kitchen during work hours, or when an employee develops a back injury from their home office chair.

- New Provider Types: As a result of the provider shortage outlined in the previous section, new types of providers, like chiropractic assistants, have been approved to bill for workers’ compensation claims in some jurisdictions. Additionally, many states have expanded the workers’ compensation rules for nurse practitioners and physician assistants; this could involve allowing them to bill directly instead of a supervising physician or giving them permissions to sign documents on their own. As the provider shortage continues, we expect to see these expansions continue, which could affect precertification, billing, reimbursement and bill review systems.

- Payer Legislation: In 2021, many states began implementing legislation that directly affects payers’ ability to manage claims. This includes introducing regulations that limit direction of care, restrict provider networks or add new administrative rules that can increase administrative burden and claims processing costs. In 2022, we expect to see more of these laws throughout the country. This type of legislation raises claims costs, which translates into cost of doing business.

- Data Privacy and Security: Many regulators throughout the country will be evaluating the effectiveness of their privacy and security laws regarding how medical data is accessed. As a result, we may see legislative and regulatory changes to address these issues.

Drug Price Transparency Will Be a Focus; Opioid and Addiction Concerns Will Continue

While the FDA’s approval of the first COVID vaccine was certainly the most significant pharmaceutical breakthrough of 2021, and the recent announcement of drug treatments for COVID-19 could be 2022’s, there will be other important pharmaceutical challenges facing injured employees and payers that might not receive as much fanfare. High-impact and specialty pharmaceuticals, drug-price transparency and regulation/price pressure, as well as continuing concerns around opioids and addiction, are just a few issues that will impact workers’ comp this year.

- High-Impact Pharmaceuticals: Despite low utilization in workers’ comp, high-impact pharmaceutical categories such as private label topical analgesics (PLTAs), compound kits and combo packs associated with exponentially significant costs will continue to be a challenge, as they remain difficult to identify, are often dispensed in physician’s offices outside of typical clinical controls and, in many jurisdictions, are unaddressed in regulations. In addition, specialty medications will continue to have a significant and increasing impact on workers’ compensation claim costs. Specialty drugs designed to treat pain are on the horizon and, once approved, their prevalence within treatment plans will grow and inevitably become a larger percentage of spend, requiring ongoing clinical monitoring and assessment.

- Drug Price Transparency: Drug pricing consistency, transparency and regulatory pressures will continue to accelerate and affect the economics of pharmacy benefit managers (PBMs) as they struggle with rising list prices and the affordability of new brand and specialty products. A recent WCRI topical analgesics study found the prevalence of topicals and their pricing varied widely from state to state. The study also revealed great variation among states for the use of gabapentin, with the average payment in Louisiana being $50 but only $3 in California.

States are also playing a role in efforts to manage access to affordable drugs. In December, a federal judge suspended California AB 824, ruling that the law intended to increase the flow of generic drugs likely violates out-of-state commerce protections, and created a presumption that "reverse payment" settlements between brand and generic pharmaceutical companies are anti-competitive and unlawful. This will impact workers’ comp PBMs, which encourage generic substitution whenever possible to reduce costs.

In addition, policymakers continue to feel pressure to address increasing drug prices and press for more transparency. Part of this effort includes a House Oversight and Reform Committee investigation focused on 10 companies selling 12 of the most expensive drugs to Medicare. Their inquiry found these drugs are priced at a median of almost 500% higher than when they came to market; some of these lawmakers are calling for legislation to allow Medicare to negotiate drug prices. If passed, this legislation could accelerate price pressure for manufacturers. - Opioid Use: Through the adoption of more aggressive clinical- intervention and opioid-management programs, opioid usage will continue to decrease for workers’ compensation patients; however, despite this, 75% of employers are being directly impacted by employee opioid misuse, according to an NSC survey. In addition, the CDC reported a record of more than 100,000 drug overdoses in the 12-month period between April 2020 and 2021, primarily driven by illicit opioids. Employers and PBMs should continue to further implement strong testing and monitoring programs to combat prescription opioid misuse and avoid adding to this growing problem.

- Technological Advances: More virtual reality devices and phone apps are being utilized to reduce pain and are likely a next frontier in pharmacy. While not a drug, FDA approval is still required and could result in management of these devices through the PBM.

Looking Ahead

Though the unpredictable course of the COVID-19 pandemic makes it challenging to predict exactly what issues will be most important to the workers’ compensation industry this year, by focusing and managing these issues in their programs, payers can be better prepared to navigate whatever comes next.